Fascination About Stock Trading

Wiki Article

Stock Trading Fundamentals Explained

Table of ContentsThe 25-Second Trick For Stock TradingStock Trading Fundamentals ExplainedThe Main Principles Of Stock Trading Stock Trading Things To Know Before You BuyThe Single Strategy To Use For Stock Trading

The broker will certainly request for your revenue range, your total possessions and also various other personal inquiries. You must be able to open up most accounts within around 15 minutes, as well as might not even have to promptly fund the account though it's generally a great concept. Most of all, let your style guide the broker agent you select.

An excellent brokerage firm can help with that, as can any type of variety of subscription stock e-newsletters and also even some complimentary sites. If you're an investor, your broker might offer suggestions for you, or you may have to do your own research study to locate fascinating sets up. That can mean evaluating great deals of stock scenarios, as an example, supplies at 52-week highs or lows, to see if they resemble they'll proceed trending.

For traders, you'll usually market when the supply hits a certain price, either a gain or loss. That might additionally hold true with financiers, though they may also hold a supply forever, riding a high-flying stock for decades with no intention of ever selling. Once you've located what you're mosting likely to trade, after that it's time to perform the profession (stock trading).

Stock Trading - An Overview

That is, if you place a market order to acquire a stock, you will certainly get at the cheapest asking price presently. If you place a market order to market a stock, you will certainly cost the highest possible bidding rate. Limitation order: With a limitation order, you define to the broker what rate you want to jump on the trade.One crucial indicate keep in mind with these order kinds is that you're beholden to the marketplace when you put a market order. You're going to obtain whatever the prevailing rate is. That's not likely to cost you anything on big, highly fluid stocks, yet you might spend or lose even more cash if you use a market order for smaller, less liquid supplies.

As a matter of fact, financiers could enjoy when a supply goes down because it may use an appealing rate to buy the stock. Trading is challenging to prosper at, due to the fact that there are many ways to screw it up. Whether trading or investing, right here are some crucial pointers to keep you from blowing up your profile.

Obviously, lots of trades will be losers. Traders who intend to live to trade one more day ought to know how to manage risk to ensure that they do not hemorrhage cash money when they do make a negative trade. That's why one of the very first policies of trading is to reduce losses prior to they transform into big losses as well as after that right into catastrophic losses.

The Best Guide To Stock Trading

Frequently these fraudulences will certainly upload concerning some unknown dime stock on an internet message board, really hoping to entice amateur investors. The goal of these plans is to relocate the stock rate higher with a quick ruptured of hype adhered to by experts offering the stock to take advantage of the run-up.You can find a design that fits you as well as your temperament. Those who wish to invest for the long-term as well as placed much less initiative right into their financial investments can exercise buy-and-hold investing, while those who live for an exciting trade can end up being investors. One attractive aspect of the market is that you reach select the style that helps you and lots of styles can be effective.

Content Disclaimer: All investors are advised to conduct their very own independent study right into investment approaches before making a financial view it investment decision. In enhancement, investors are recommended that previous investment item performance is no guarantee of future cost appreciation.

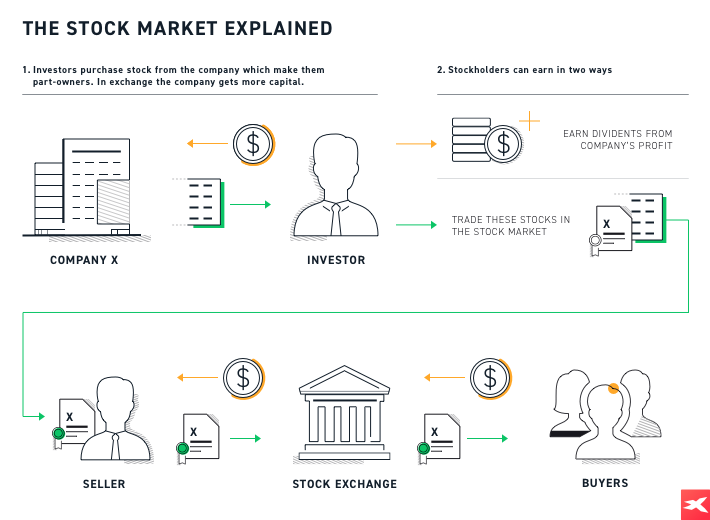

Get. Offer. Hold. Dealing stocks can sound interesting, complex, and also puzzling at one time. Yet it does not have to be. The very first step to understanding when to get and also offer supplies is recognizing just how a supply market or stock exchange works. The initial point to understand: There isn't just one stock marketthere are many stock market and also markets worldwide with which people deal stocks, or shares of a business.

Things about Stock Trading

Possibly the fundamental company behind the stock is negative and also the business is mosting likely to lose money. Or the supply cost can transform because of a record from an analyst, a rumor regarding coming company actions, or overall financial news. Due to the fact that of all that volatility, it can be dangerous for individual financiers to purchase and also market stocks to make an earnings, so numerous investors favor financial investments like ETFs, index funds, or mutual funds, which include several stocks in one cool package.

Then you can locate a design that fits you and your character. Those that want to invest for the lengthy term as well as put much less initiative into their investments can practice buy-and-hold investing, while those that live for an exciting profession can come to be investors. One attractive point regarding the market is that you reach choose the design that benefits you as well as several designs can be hop over to these guys effective.

Editorial Disclaimer: All financiers are suggested to conduct their own independent study into financial investment methods before making a financial investment decision. Furthermore, capitalists are advised that previous financial investment product efficiency is no guarantee of future price recognition.

About Stock Trading

Get. Purchasing and also selling stocks can appear exciting, challenging, and also confusing all at when. The initial thing to understand: There isn't simply one supply marketthere are many supply exchanges and also markets worldwide through which people get and also sell stocks, or shares of a firm.

Perhaps the essential business behind the stock misbehaves and also the business is mosting likely to lose money. Or the supply price might transform because of a report from an analyst, a report concerning coming company actions, or total economic news. Due to all that volatility, it can be risky for private financiers to deal supplies to earn a profit, a lot of capitalists prefer financial investments like ETFs, index funds, or common funds, which contain numerous stocks in one cool bundle.

Report this wiki page